Choosing between competing harder in an existing market and trying to redefine the market itself is one of the most misunderstood strategic decisions in marketing. Many teams default to differentiation language without confronting the structural realities of their category, their capabilities, or their customers’ willingness to change. The result is often a strategy that sounds bold but behaves like business as usual.

The core dilemma is not innovation versus competition, but whether value creation happens inside or outside existing market rules. This article unpacks Blue Ocean Strategy vs Red Ocean Strategy from a practical, decision-focused perspective. The goal is to help you assess which path fits your market maturity, cost structure, and strategic constraints, rather than assuming that creating a new market space is always the superior choice.

What Red Ocean Strategy Optimizes

Red Ocean Strategy operates within clearly defined market boundaries. Demand is known, competitors are visible, and customer expectations are shaped by existing alternatives. The strategic objective is relative advantage, meaning outperforming competitors on price, features, distribution, or brand within shared rules.

A common misconception is that Red Ocean Strategy is inherently unsophisticated. In reality, it rewards execution excellence and operational discipline. The limitation is structural: as more players optimize toward similar benchmarks, differentiation erodes and price pressure increases.

- Competition is based on comparable value metrics.

- Growth often comes from stealing share, not expanding demand.

- Efficiency and scale matter more than narrative innovation.

When Blue Ocean Strategy Actually Works

Blue Ocean Strategy aims to redefine the basis of competition by creating uncontested market space. Instead of outperforming rivals, you change what customers value. The decision rule is whether unmet demand can be activated without relying on competitor response.

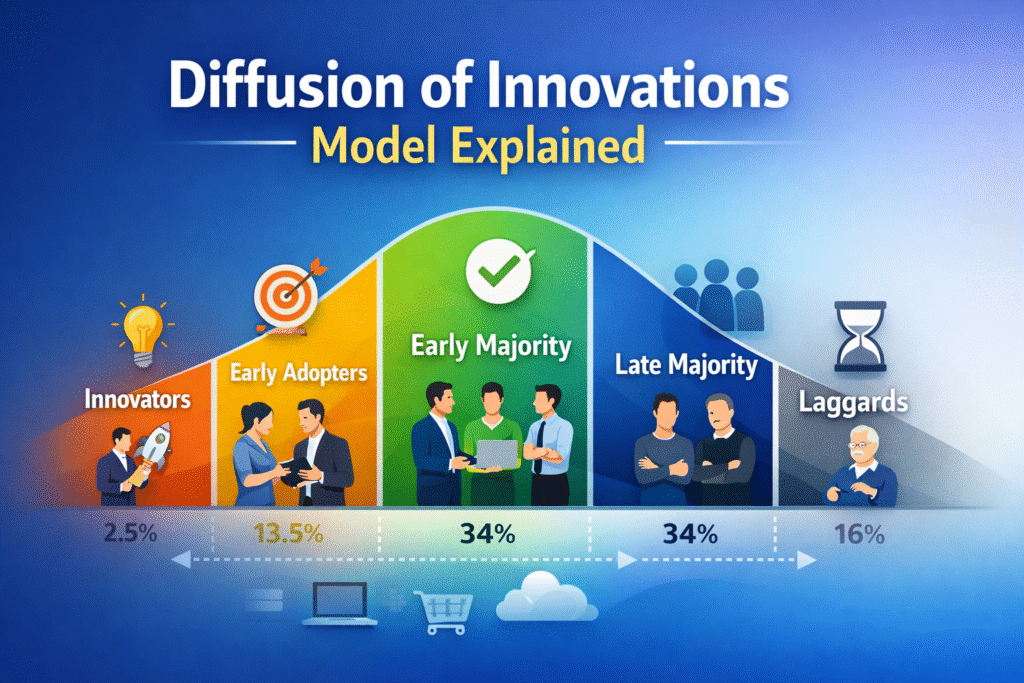

This approach only works when customers are willing and able to reframe their buying criteria. Many attempts fail because teams underestimate adoption friction or overestimate how novel their offering really is.

- The problem addressed must be latent or poorly served.

- The value proposition must reduce complexity, not add it.

- The organization must sustain a learning phase without immediate benchmarks.

Strategic Trade-offs and Hidden Costs

Both strategies carry costs that are often ignored in high-level frameworks. Red Ocean strategies trade margin for predictability, while Blue Ocean strategies trade certainty for optionality.

Choosing a Blue Ocean path means absorbing education costs, slower revenue ramp-up, and internal ambiguity. Choosing a Red Ocean path means accepting commoditization risk and ongoing margin defense. The mistake is treating either as a pure upside move.

Strategic clarity comes from matching ambition to constraints, not from copying canonical case studies.

Marketing and Positioning Differences

Marketing execution changes significantly depending on the strategic choice. In Red Oceans, marketing clarifies superiority. In Blue Oceans, marketing explains relevance.

Red Ocean messaging focuses on proof, comparison, and reassurance. Blue Ocean messaging focuses on reframing problems and legitimizing a new category. The latter requires more narrative consistency and patience.

- Red Ocean marketing emphasizes benchmarks and alternatives.

- Blue Ocean marketing emphasizes use cases and mental models.

- Positioning failure is more costly in Blue Oceans due to low category awareness.

Blue vs Red Strategy Comparison

The table below highlights the strategic differences that matter in decision-making, not surface-level definitions.

| Dimension | Red Ocean Strategy | Blue Ocean Strategy |

|---|---|---|

| Market Structure | Existing, well-defined | New or redefined |

| Primary Risk | Price erosion | Adoption failure |

| Growth Source | Market share gains | Demand creation |

| Marketing Role | Differentiation proof | Category education |

| Operational Focus | Efficiency and scale | Learning and iteration |

Example Case

A mid-sized B2B SaaS company operated in a crowded project management market with entrenched competitors. The leadership team considered repositioning around an entirely new planning philosophy to escape price competition.

After analysis, they rejected a full Blue Ocean move. The alternative would have required educating buyers who were already fatigued by new frameworks. Instead, they chose a Red Ocean approach focused on a narrow segment with specific compliance needs.

The decision constrained narrative freedom but enabled faster sales cycles and clearer competitive comparisons.

Key takeaways:

- Market education costs can outweigh differentiation benefits.

- Strategic focus can outperform conceptual novelty.

Strategic Guideline

The most reliable guideline is simple but restrictive. Choose Blue Ocean only when customers already feel the problem but lack language or options. Choose Red Ocean when customers understand the problem and are comparing solutions.

Strategy fails when ambition ignores buyer psychology and organizational capacity. The question is not which framework sounds more visionary, but which one aligns with how your market actually behaves.

Frequently Asked Questions

Is Blue Ocean Strategy always more innovative?

No. It often involves recombining existing elements rather than creating new technology.

Can small companies succeed with Red Ocean Strategy?

Yes, if they focus on a defensible niche and execute with discipline.

Why do many Blue Ocean attempts fail?

They underestimate customer inertia and overestimate willingness to change behavior.

Can a company switch strategies over time?

Yes, but switching requires structural changes, not just new messaging.

How should marketing teams influence the choice?

By validating demand signals and testing whether customers understand the proposed value shift.